Get a clear understanding of scholarships, grants, and loans! Learn about eligibility, application process, repayment, and more in this comprehensive guide.

In today’s complex landscape of financial aid, it is crucial to have a clear understanding of the differences between scholarships, grants, and loans. When navigating the world of higher education, these terms can often be used interchangeably, causing confusion for students and their families. However, each of these forms of financial assistance has distinct characteristics, eligibility requirements, and repayment obligations. By gaining a comprehensive understanding of the nuances between scholarships, grants, and loans, you can make informed decisions that will have a significant impact on your educational journey and financial well-being.

Scholarships

Definition

Scholarships are financial aid awards given to students based on various criteria, such as academic achievement, athletic performance, or specific talents. Unlike loans, scholarships do not require repayment, making them a desirable option for students seeking funding for their education.

Source of Funding

The funding for scholarships can come from various sources, including private organizations, businesses, government agencies, and educational institutions. These entities allocate funds to support students in pursuing their educational goals.

Eligibility

Eligibility for scholarships varies depending on the specific criteria set by the scholarship provider. Common eligibility factors include academic performance, extracurricular involvement, community service, leadership skills, and financial need. Scholarships can be targeted towards specific groups, such as minority students, first-generation college students, or individuals pursuing specific fields of study.

Application Process

Applying for scholarships usually involves submitting an application form, which can require personal information, academic transcripts, letters of recommendation, and essays. Some scholarships may also require applicants to attend an interview or provide a portfolio showcasing their talents, depending on the nature of the scholarship.

Selection Criteria

Selection criteria for scholarships differ based on the scholarship provider’s objectives. Academic scholarships often prioritize GPA and standardized test scores, while athletic scholarships consider an athlete’s performance and potential. Other scholarships may focus on leadership qualities, community involvement, or unique talents. Some scholarships incorporate a combination of factors to determine the most deserving recipients.

Amount

Scholarship amounts can vary greatly, ranging from a few hundred dollars to full-ride scholarships covering tuition, fees, and sometimes additional expenses. Scholarships may be renewable annually, providing ongoing financial support throughout a student’s academic journey.

Renewability

Some scholarships are renewable for multiple years, provided that the student maintains certain academic standards or meets specific requirements outlined by the scholarship provider. This allows students to receive funding throughout their entire undergraduate education, relieving the financial burden associated with tuition and fees.

Prestige

Certain scholarships carry significant prestige and recognition within the academic and professional communities. These highly competitive scholarships, such as the Rhodes Scholarship or the Fulbright Scholarship, are recognized as prestigious honors and can greatly enhance a student’s resume or curriculum vitae.

Taxability

In the United States, scholarships may be subject to taxation depending on their purpose and usage. Generally, scholarships used for tuition and required academic fees are tax-free. However, if a scholarship covers living expenses, it may be considered taxable income. It is important for scholarship recipients to consult with a tax professional or refer to the IRS guidelines to determine their specific tax obligations.

Repayment

Unlike loans, scholarships do not require repayment. This is one of the significant advantages of receiving scholarship funds. Students can focus on their education without the stress of accumulating debt or the burden of having to repay the funding later in life.

Grants

Definition

Grants are financial assistance provided to individuals or organizations for specific purposes, such as research, projects, or academic pursuits. Similar to scholarships, grants do not require repayment and can provide valuable financial support to those in need.

Source of Funding

Grant funding can come from various sources, including government agencies, foundations, non-profit organizations, or private entities. These organizations allocate funds to support individuals or groups engaged in activities aligned with their mission or goals.

Eligibility

Eligibility for grants depends on the specific requirements set by the grant provider. Grants can be awarded based on factors such as academic merit, research proposals, community initiatives, or the specific needs of an individual or organization. Some grants target specific populations, such as low-income students, women in STEM fields, or minority-owned businesses.

Application Process

The application process for grants typically involves submitting a detailed proposal outlining the purpose, goals, and budget of the project or initiative. Applicants may need to provide supporting documents, such as resumes, letters of recommendation, financial statements, or research plans. Grant applications often require careful planning and consideration to meet the specific requirements and demonstrate the potential impact of the proposed project.

Selection Criteria

Grant selection criteria vary depending on the objectives and priorities of the grant provider. Factors such as the feasibility of the project, its potential impact, alignment with the organization’s mission, and the applicant’s qualifications are typically evaluated. Review committees or panels of experts assess grant applications and select recipients based on the strength of their proposals.

Amount

The amount of grant funding can range from a few hundred dollars to substantial sums, depending on the nature of the project and the availability of funds. Grants may cover various expenses directly related to the project, such as research materials, equipment, personnel salaries, or conference fees.

Renewability

Grant renewability depends on the specific terms set by the grant provider. Some grants are awarded for a specific project or time frame, while others may be renewable for multiple years. Renewability often depends on the project’s progress, compliance with reporting requirements, and the availability of funding.

Types of Grants

Grants can be categorized into different types based on their purpose or focus. Some common types include research grants, education grants, community development grants, and start-up grants for new businesses. Each type of grant serves a specific purpose and supports individuals or organizations in different stages of their endeavors.

Prestige

Certain grants are highly competitive and prestigious within their respective fields. For example, research grants from renowned institutions or government agencies can provide recognition and credibility to researchers. Grants that enable individuals to pursue advanced degrees or specialized training from prestigious institutions can enhance their professional reputation.

Taxability

In the United States, grant funds may be subject to taxation depending on their purpose and usage. Generally, grants used for qualified educational expenses or research-related activities are not taxable. However, grants used for personal expenses or unrelated purposes may be considered taxable income. Consulting a tax professional or referring to the IRS guidelines is crucial to determine the tax implications of grant funding.

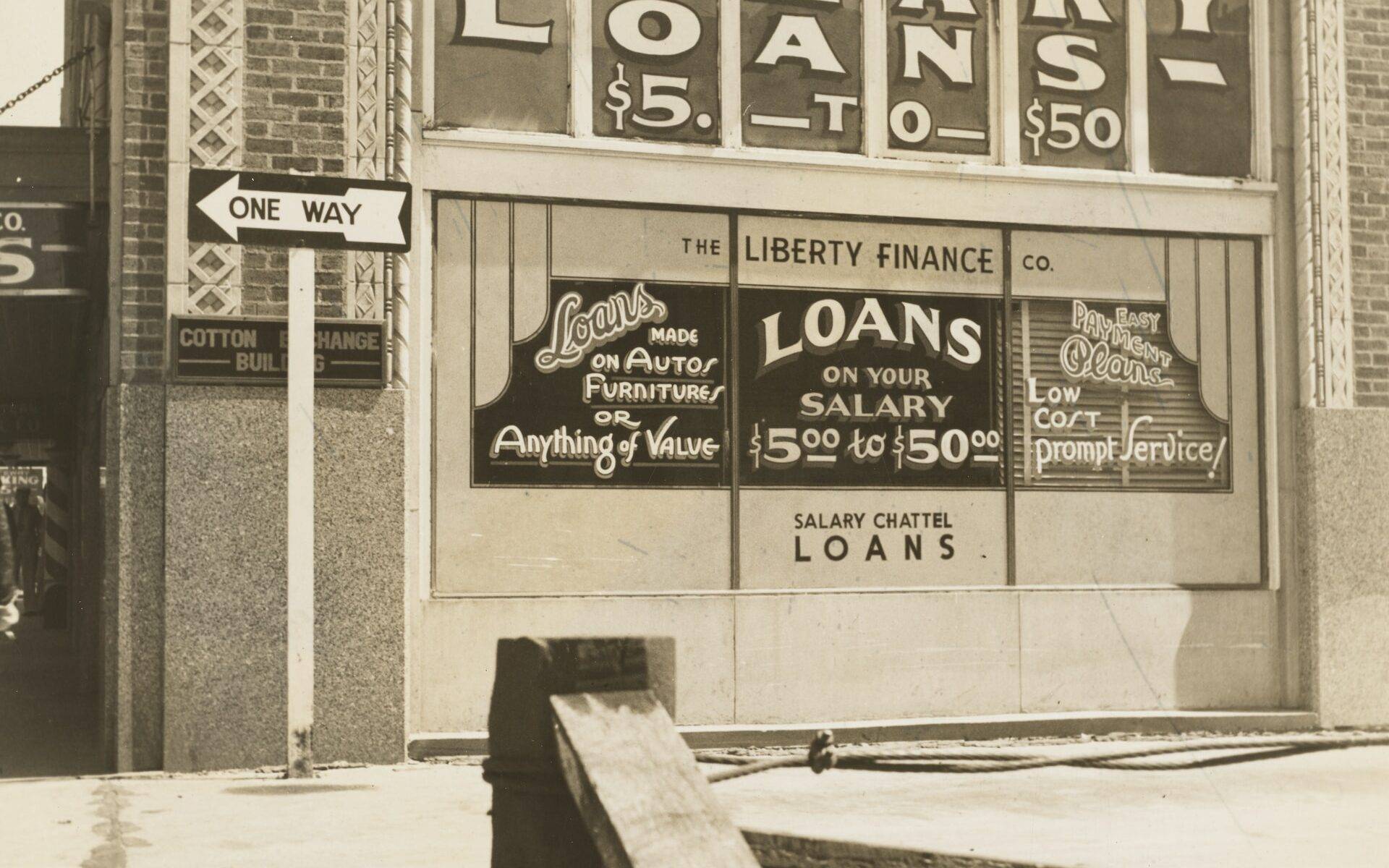

Loans

Definition

Loans are financial agreements in which a lender provides funds to an individual or organization, with the expectation that the borrowed amount will be repaid with interest over a specified period. Unlike scholarships and grants, loans require repayment, and they can provide access to immediate funds required for educational or other purposes.

Source of Funding

Loans can be obtained from various sources, such as banks, credit unions, financial institutions, or government agencies. Each lender may have specific terms, interest rates, and repayment options, allowing borrowers to choose the loan option that best suits their needs.

Eligibility

Eligibility for loans depends on factors such as credit history, income, and repayment capacity. Some loans, like federal student loans, have specific eligibility requirements, while private loans often consider factors like credit score, employment history, or cosigner availability.

Application Process

Applying for a loan typically involves submitting an application form, providing personal and financial information, and agreeing to the terms and conditions set by the lender. Depending on the type of loan, additional documentation, such as tax returns, pay stubs, or proof of assets, may be required to assess the borrower’s financial stability and ability to repay the loan.

Interest Rate

Loans accrue interest over the repayment period, which is an additional cost borne by the borrower. The interest rate varies depending on the type of loan, the borrower’s creditworthiness, and market conditions. It is important for borrowers to compare interest rates from different lenders to secure the most favorable loan terms.

Repayment

Loan repayment typically begins after a certain grace period or upon completion of the loan term. Repayment plans can vary, including fixed monthly installments, graduated repayment plans, income-driven repayment options, or deferment options for specific circumstances like returning to school or facing financial hardship.

Types of Loans

There are various types of loans available to borrowers, each serving different purposes and offering specific terms. Examples include federal student loans, private student loans, personal loans, auto loans, home mortgages, and small business loans. Each loan type has its own eligibility criteria, interest rates, repayment options, and terms.

Loan Forgiveness

Loan forgiveness programs exist to provide relief to borrowers who meet specific criteria. For example, certain public service jobs may qualify individuals for loan forgiveness after a certain period of service and consistent loan payments. Additionally, some student loan forgiveness programs are available for borrowers working in various fields such as education, healthcare, or non-profit organizations.

Prestige

Loans, unlike scholarships or grants, do not possess inherent prestige. However, prestigious educational institutions or loan programs may carry a certain level of reputation within the academic and professional communities. Borrowers may prefer loans from well-established institutions or programs known for their excellent support services or flexible repayment options.

Taxability

Loan funds are not considered taxable income since they require repayment. However, borrowers may be eligible for certain tax deductions related to student loan interest payments. It is essential for borrowers to consult with a tax professional or refer to the IRS guidelines to understand the potential benefits or obligations related to their specific loan situation.

In conclusion, scholarships, grants, and loans are significant financial resources that can assist individuals in pursuing their educational or professional goals. Understanding the differences and characteristics of each option allows prospective students and individuals seeking financial assistance to make informed decisions regarding their funding options. Whether it is through scholarships that provide merit-based awards, grants that support specific projects or initiatives, or loans that offer immediate access to funds, each funding source has its own advantages, eligibility requirements, and repayment obligations. By carefully considering these factors, individuals can find the most suitable option to achieve their educational aspirations without compromising their financial well-being.